How to effectively establish a consultancy business in the mining and resources sector – part 2

Key takeaways

- In this two-part series, Craig and Ian delve further into the three important areas, which business owners within the mining and resources sector should be aware of.

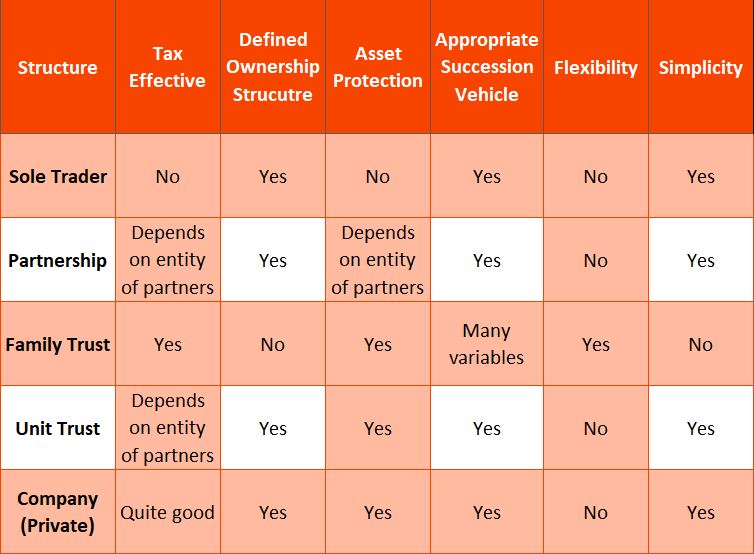

- A breakdown on the advantages and disadvantages of various structures business owners can use.

- A look at funding options and employment agreements to consider when growing your business.

In how to effectively establish a consultancy business in the mining and resources sector – part 1 we set out various important issues for your consideration. Here we expand on three of them: asset protection and tax minimisation, funding, and employment law issues.

1. Asset protection and tax minimisation

Most consultancies are set up as a sole trader, partnership, company or trust (family or unit) business entity (or structure). Each offers combinations in terms of:

- simplicity or complexity

- asset protection or asset risk

- tax minimisation or not

- cost of operating structure.

In deciding on a structure you will need to take legal and accounting advice to weigh up the costs and benefits of each. This table compares the advantages and disadvantages of the various structures.

Sometimes by mixing the structures the disadvantages of one structure can be minimised. For example, the business can be operated by a unit trust. The units in that trust can be owned by various family trusts. This structure can allow the income of the business owned by the unit trust to be spread widely.

Another example is that a partnership can be a partnership of trusts. This can give some asset protection and better tax-effectiveness. As you can see, it is essential to take good legal and accounting advice when setting up your structure.

2. Funding

Funding can be by way of equity (contribution by stakeholders), loans from stakeholders or related parties, or loans from financial institutions. The appropriate funding mix for your situation will depend on various factors. You will need to take legal and accounting advice to determine this. The basic issues to be aware of are these:

- Banks usually won’t lend to a small business without real estate security and personal guarantees. This will usually be provided by the stakeholders. If there is more than one stakeholder you will need agreements between the stakeholders as to what happens if those personal guarantees or real estate security are ever called upon.

- Loan funds provided by stakeholders themselves should be provided as a secured loan to the business.

- Loan funds from stakeholders should match the stakeholding.

- Accounting advice should be sought in deciding whether loan funds or equity funds should be provided as there are various factors which would determine the best mix tax-wise and asset protection-wise.

3. Employment Law issues

If you have employees, you should have written agreements with those employees. You should take legal advice regarding this. You should also be aware of basic employment law rules, such as:

- The National Employment Standards (NES) in the Fair Work Act prescribe employees minimum entitlements such as leave, weekly hours and notice.

- Employees may be governed by Modern Awards which prescribe certain terms and conditions in addition to the NES.

- You must give every employee upon commencing employment a Fair Work Information Statement.

- There are specific rules and law concerning redundancy, resignation and dismissal and if you as the employer get this process wrong, you may have to defend an action in the Fair Work Commission.

- Caution must be taken in relation to casual workers as in certain circumstances a casual employee may be entitled to some or all of the entitlements of a permanent employee.

- In some circumstances it may be more effective for your and the other party to have a contractual relationship, not an employment relationship. This is a very complex area of the law and you should seek legal and accounting advice as to what you can and cannot do in this scenario.

Craig Hong and Ian Hillhouse are regular contributors for the leading mining and resources publication Resources Unearthed. They regularly provide advice across a spectrum of often complex legal matters within this sector.

Click here to read the original article in full.

The information in this blog is intended only to provide a general overview and has not been prepared with a view to any particular situation or set of circumstances. It is not intended to be comprehensive nor does it constitute legal advice. While we attempt to ensure the information is current and accurate we do not guarantee its currency and accuracy. You should seek legal or other professional advice before acting or relying on any of the information in this blog as it may not be appropriate for your individual circumstances.